WHY YOU SHOULD

IMPLEMENT AN OPTIONAL PROGRAM?

IMPLEMENT AN OPTIONAL PROGRAM?

ESOP helps to attract and retain talents

01

It motivates employees to selfless work for the benefit of the company and its success

02

Small companies can successfully compete with large ones for the best employees

03

Creates the ownership mentality within employees

04

You do not have to spend cash on employee bonuses

05

Creates investment attractiveness

06

about our project

According to the survey

EY 2021

EY 2021

According to the survey

EY 2021

EY 2021

what do

we offer

we offer

04

Esopa can emit a financial instrument, which will perfectly suit your needs. This may be notes for the equity finance round or corporate bonds at a fix yield. You may also emit convertible notes for your investors, which will dramatically simplify due diligence process and save much time on the closing. Your investors will simply buy your notes and hold them on their brokerage account

NOTES

EMISSION

EMISSION

03

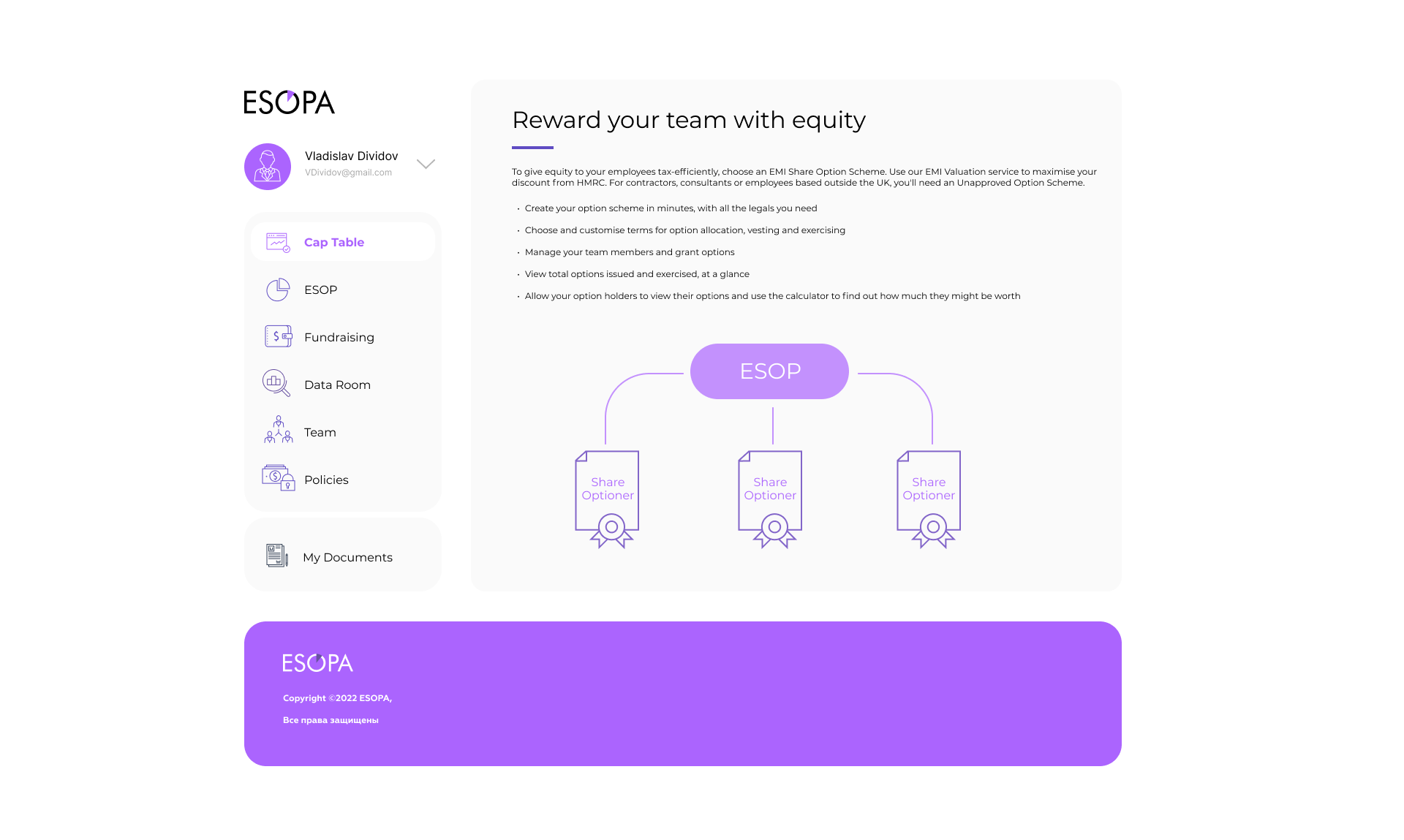

Depositary program is held and managed by the regulated financial institution. Shares are vested automatically according to the terms of the program. When the option is exercised, employees receive a security with an ISIN assigned to it.

DEPOSITARY

OPTIONS

OPTIONS

02

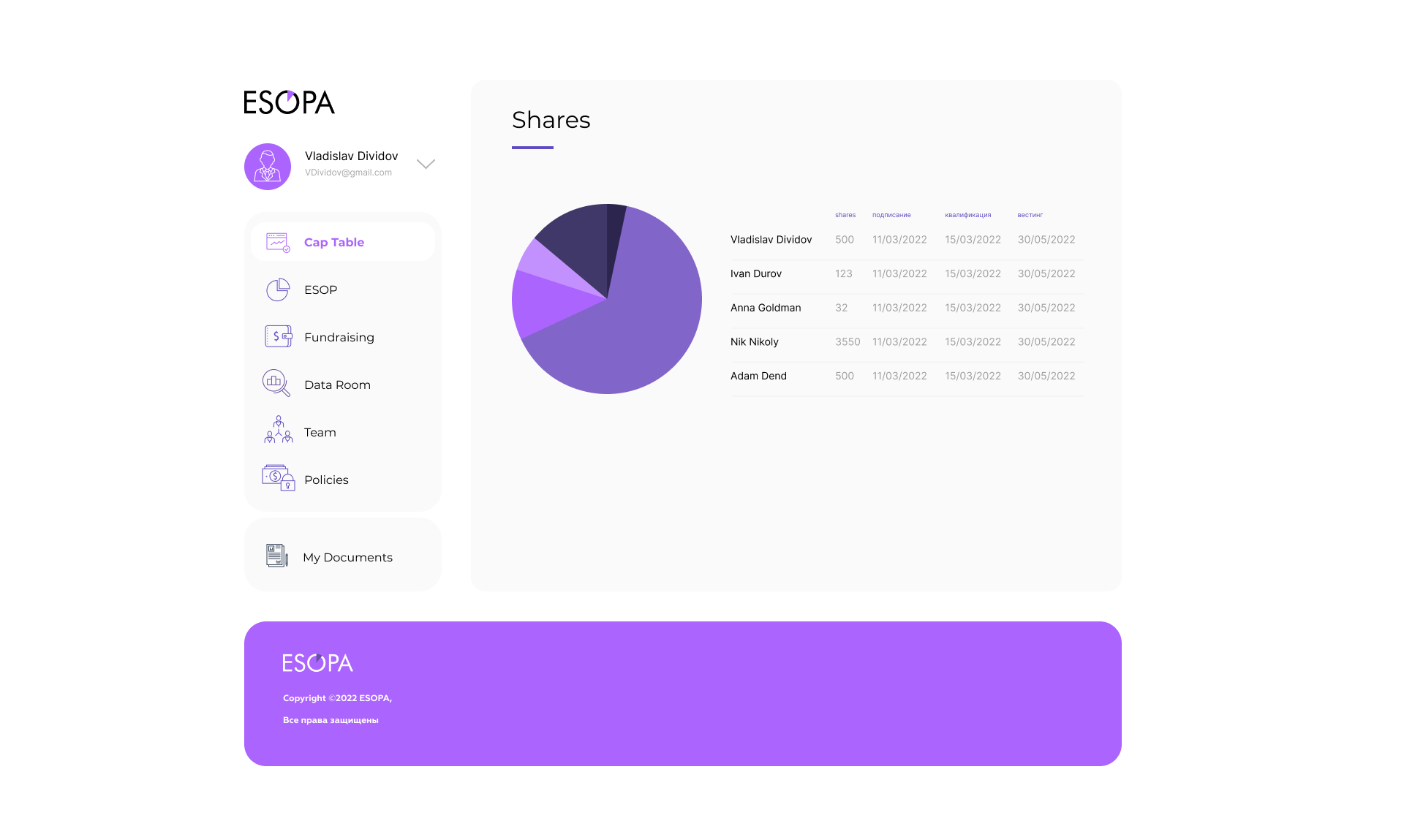

ESOP is the employee share program designed for the transfer of shares to key employees, advisors and consultants. Convenient if it is important to motivate staff with shares, but for some reasons cannot be done in cash. We will explain the pros and cons of paying through various structures and determine how beneficial this instrument is for you.

ESOP

01

Fantom option is a right to be paid a cash amount representing the value of notional Shares. Employees are enjoyed receiving a cash bonuses on the liquidity event such as IPO, company sale, or a change of control. Employers, on the other hand do not dilute their capital and avoid bureaucracy

FANTOM

OPTIONS

OPTIONS

How

it works

it works

1

Identifying your goals

on how to best motivate your employees and define the program type

2

Requesting board resolution

to adopt an option program

3

Define what employees

will be enrolled into the program

will be enrolled into the program

4

Set cliff period vesting

and condition on exercise for each employee

and condition on exercise for each employee

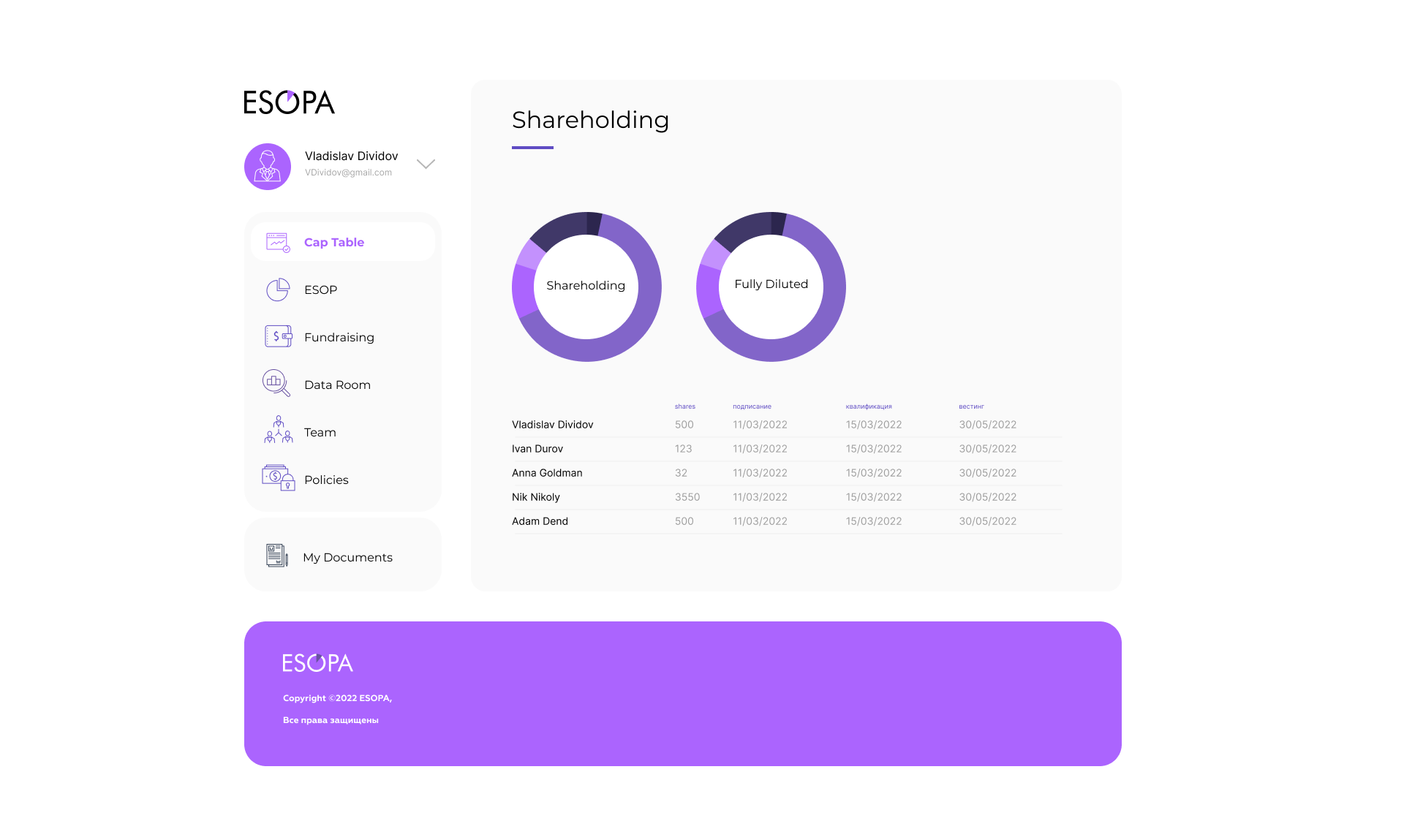

Keep management

of the company in your hands

of the company in your hands

Our proprietary platform allows you to easily manage the shareholders, removing and adding new option holders or investors

Allows you to monitor how the vesting

of shares occurs and when the right to

exercise the option arises.

of shares occurs and when the right to

exercise the option arises.

It's easy to see how the capital dilutes once a new shareholder is added to the capital.

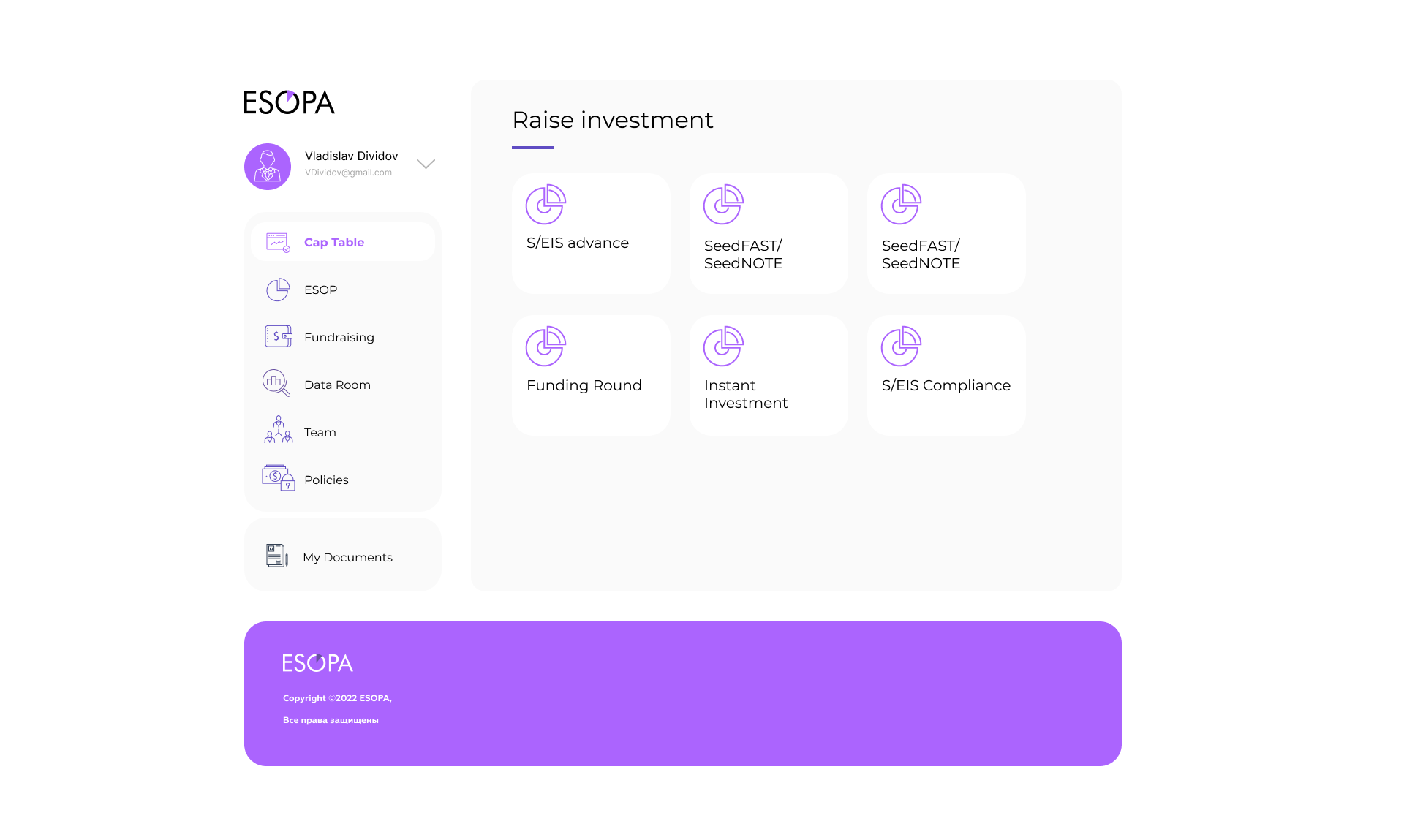

The fastest way to fundraise before

a round and close the next round.

We provide all the support you need from our team of lawyers and financial experts,

along with a ready-made package

of documents and a confidential

data room

a round and close the next round.

We provide all the support you need from our team of lawyers and financial experts,

along with a ready-made package

of documents and a confidential

data room

pricing

Fantom Option

ESOP

Depositary option

per contract

per month

per month

From 990$

290$

190$

Copyright ©2022 ESOPA,

All rights reserved

All rights reserved

info@esopa.net

Leave a request today